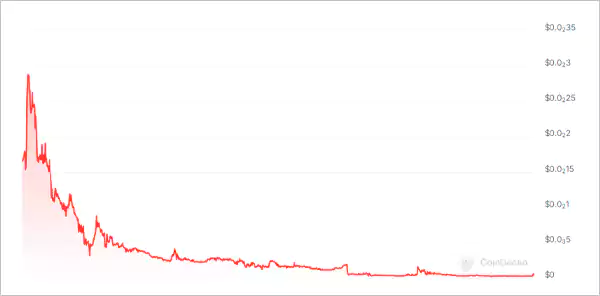

SafeMoon set ablaze the crypto market soon after its launch, and the coin value rose by 20,000%. Currently, SafeMoon’s price has significantly lowered, reaching an all-time low.

Investors are in doubt whether SafeMoon is still a viable investing option considering all the massive hits the project took. After several conspiracies and allegations surrounding the coin, it has resulted in getting delisted on several trading platforms.

However, the coin can still be purchased, but does it still hold the potential to perform in such a dynamic market? Let’s talk about the way around how to buy SafeMoon coins and whether it’s going to be a smart investing move.

SafeMoon was first circulated on 8 March 2021 with a token supply of one trillion. Soon, this altcoin created a buzz in the market due to its unparalleled reward system, seemingly making it a solid investment.

In December 2021, SafeMoon launched V2 of the coins with updated security, and for every migration of one token, investors would receive 1000 tokens. The team was planning to launch its so-called SafeMoon card, which could be used as a debit card to buy goods with a 2.5% service charge.

Additionally, what sets SafeMoon crypto apart is its:

The supply of tokens was also reduced to pump the coin value through the process of manual burning. In this practice, crypto coins are transferred to a unique wallet address that can’t be accessed.

SafeMoon soon became viral after it was heavily endorsed by renowned celebrities such as Jake Paul, Soulja Boy, and Nick Carter, making it a trustworthy project.

But the real question arises: what suddenly happened to SafeMoon, and is it still available to buy?

SafeMoon is still available to buy on several platforms, and currently, 560 billion coins are in supply. If you find MoonCoins to be listed anywhere, it would probably be a scam.

As per rules and regulations, the coin has been delisted from prominent platforms like Coinbase, Binance, and SunCrypto. And it is unlikely you can purchase them directly with fiat currency.

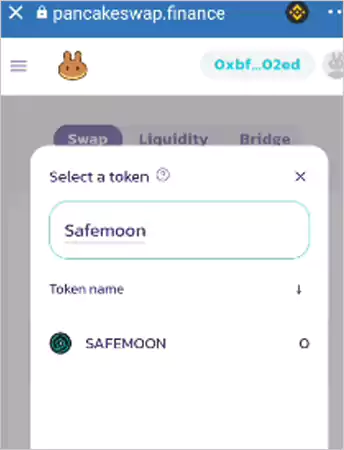

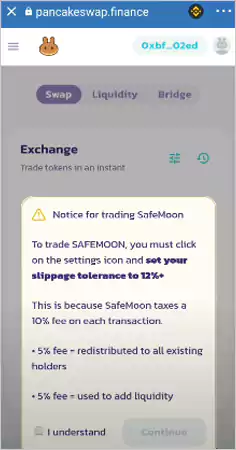

As for now, there are two methods to buy SafeMoon, which are listed below.

The first method requires using a crypto wallet, either MetaMask or Electrum; it’s up to you.

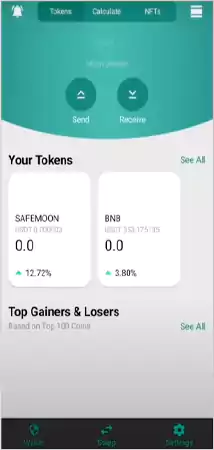

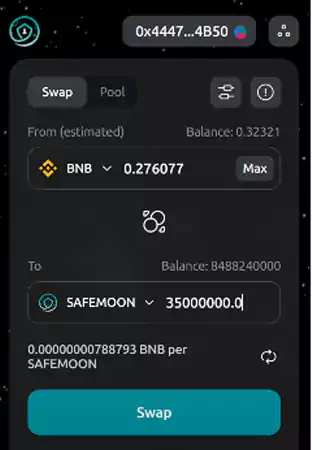

This one is a more direct approach; first, simply download the SafeMoon wallet app on your device.

These are the two methods you can use to buy SafeMoon crypto. However, before making a purchase decision, it is necessary to carefully assess various elements of the coin.

Let’s take a look at the fundamental factors of SafeMoon and evaluate its pros and cons.

Even after having low gas fees and stable price movement, SafeMoon is a leap of faith for the portfolio. There are some positives and drawbacks to the coin that need to be addressed.

Evaluating the fundamentals of the coin through pros and cons clearly helps investors to make an informed decision. Moreover, let’s take a look at the technical aspect of SafeMoon by monitoring its price trends.

Founders of SafeMoon Kyle Nagy, Braden John Karony, and Thomas Smith had the vision to introduce something that is stable in the dynamic world of crypto. The concept is similar to pegged crypto altcoins, but SafeMoon is nothing like Tether (USDT), which is pegged to the US dollar.

SafeMoon took a huge jump from its launch price of $0.0000000010, reaching $0.000285774 within a few weeks. Soon the project faced several allegations from prominent researchers that hampered the coin value. Many investors believed the value would be restored just like Dogecoin’s value after Trump’s declaration of DOGE, but it happened just the opposite.

The report came out, which stated that funds were taken from the reserve liquidity pool, and amidst such severe allegations, the price chart never got a solid uptrend.

On 29 March 2023, a group of hackers exposed the biggest security flaw in the SafeMoon project, where $9 million worth of tokens were depleted. The final nail in the coffin was on November 1, 2023, when the founders of SafeMoon were charged with fraud.

The team at SafeMoon faced charges of money laundering, securities fraud, and wire fraud. The founders made a false claim about the robust, secure system of liquidity, and purportedly millions of dollars were used for personal benefit.

SafeMoon’s Liquidity pool wasn’t locked and merely was just false promise made to attract investors. When this news came out, many investors started withdrawing their money due to which SafeMoon lost its worth overnight.

As a result, SafeMoon declared bankruptcy, and founding members Karony and Smith were arrested. The operations got shut down and the founders had to liquidate their assets to settle their debts. This was the major reason behind SafeMoon getting delisted from trading platforms.

According to the current trend, the future of SafeMoon looks uncertain, and there is a high chance it could be a Ponzi scheme. According to the auditing report from Hashex, it has been found that investors’ money is at great risk, and this DeFi project can collapse at any moment.

There are chances of rug pull, a condition in which project owners take away the investor’s money and disappear. Moreover, Hashex claimed a potential $20 million scam could happen if their liquidity pool is compromised.

It is difficult to make a SafeMoon price prediction, especially considering the lawsuit and all such allegations. One ray of hope with SafeMoon is that currently VGX has acquired the project and is looking to restore its value.

You can follow their X (Twitter) account to catch up on all the current updates and the latest news.

It is now evident how volatile the dynamics of SafeMoon could be, and making an investment choice could severely affect your portfolio.

Understanding the landscape of coins becomes important to avoid any monetary hiccups, and one should not invest blindly based on endorsement.

If you think adding SafeMoon coins to your portfolio could potentially benefit you, make a thorough analysis first. It is always preferred to take a financial expert’s opinion or conduct independent research before investing in SafeMoon.

SafeMoon has been heavily promoted by boxer Jake Paul, DJ Afrojack, and musician Lil’ Yachty are renowned celebrities to promote SafeMoon.

SafeMoon V2 has reduced transaction fees, better security, and token consolidation of 1:1000.

It is very unlikely to happen in the near future; day-by-day the coin is losing its value and is likely to be dead by 2030 or even earlier.

You can sell SafeMoon, but first, you are required to convert the coin to BNB (Binance Coin).

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.