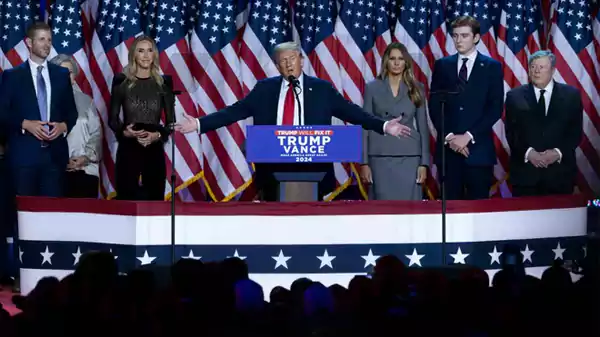

Donald Trump’s win in the US presidential election 2024 would affect the US markets everywhere. The results hit a dollar high over four months, bitcoins rose, and stocks up.

However, the elections also proposed import tariffs high, potentially leading to higher prices of products to consumers. “A tariff is a tax paid by an importer to import goods from a foreign country.”

NRF Vice President of Supply Chain and Customs Policy Jonathan Gold said in a statement, “Retailers rely heavily on imported products and manufacturing components so that they can offer their customers a variety of products at affordable prices.” Therefore, the tax growth on tariffs can burn the consumers’ pockets through higher product prices.

During the presidential election, Trump’s administration imposed a 25% tax on more than $360 billion products of China. Reportedly, he plans to charge a 60% tax on China goods and a 10% to 20% tax on all imports in the US which cost $3 trillion annually.

Treasury Secretary Janet Yellen shared his views with other economists and warned that imposing heavy taxes will increase inflation.

Last month at the Economic Club of Chicago, Trump mentioned that foreign countries will pay the tax on goods and services. But in reality, American importers should pay taxes to the US Customs and Border Protection agency.

Moreover, Trump argued that tariffs encourage American companies to manufacture goods in the US rather than purchasing from foreign countries.

“If we get tariffs, we will pass those tariff costs back to the consumer,” Philip Daniele, CEO of AutoZone, told Wall Street analysts in an earnings call in late September.

He said, “We’ll generally raise prices ahead of — we know what the tariffs will be — we generally raise prices ahead of that.”

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.